In 2026, Africa is expected to be one of the world’s most dynamic regions for investment in hydrocarbon exploration and production. According to the State of African Energy 2026 Outlook report by the African Energy Chamber (AEC), global spending on oil and gas exploration and production is projected to reach around $504 billion, with nearly $41 billion expected to be invested in Africa representing about 8% of global expenditure.

This renewed interest follows several years of underinvestment and signals a stabilization of capital flows into the continent’s energy sector. However, these investments are not evenly distributed. They are largely concentrated in a limited number of attractive countries, particularly around deep offshore projects and integrated gas developments.

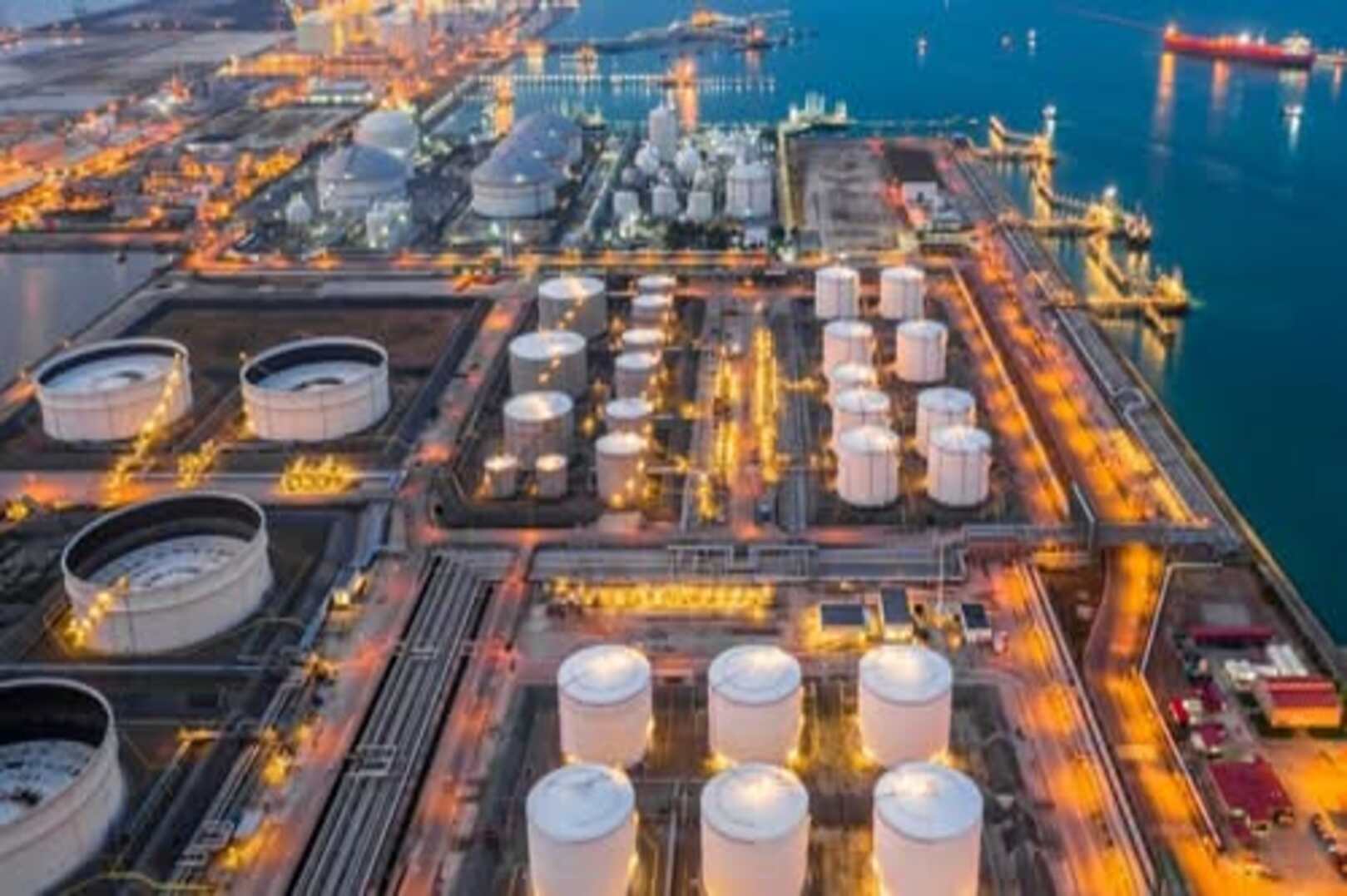

Countries such as Nigeria, Mozambique, Angola, Namibia and Senegal are among the main beneficiaries, driven by large-scale offshore discoveries and liquefied natural gas projects. These developments have strengthened investor confidence in Africa’s long-term energy potential.

Despite these positive prospects, the growing selectivity of investors highlights a new reality: the mere presence of natural resources is no longer sufficient to attract capital. Investors now prioritize countries that offer a stable regulatory environment, clear market outlets and the ability to rapidly develop and monetize projects.

In this context, Africa’s hydrocarbon production is expected to remain around 11.4 million barrels of oil equivalent per day in 2026, with ambitions to increase output in the coming years through new projects and improved investment conditions.

Overall, Africa’s ability to capture a greater share of global energy investment will depend on its capacity to combine resource potential with policy stability, regulatory clarity and efficient project execution.