UEMOA Trade Balance (H1 2025): Côte d’Ivoire Confirms Its Role as a Regional Pillar

In the first half of 2025, the trade balance of UEMOA countries presented a mixed picture, oscillating between surpluses driven by raw materials and persistent deficits due to a strong dependence on imports. Behind the numbers lies a region still dominated by the export of primary products, with very uneven performance across countries and global market cycles.

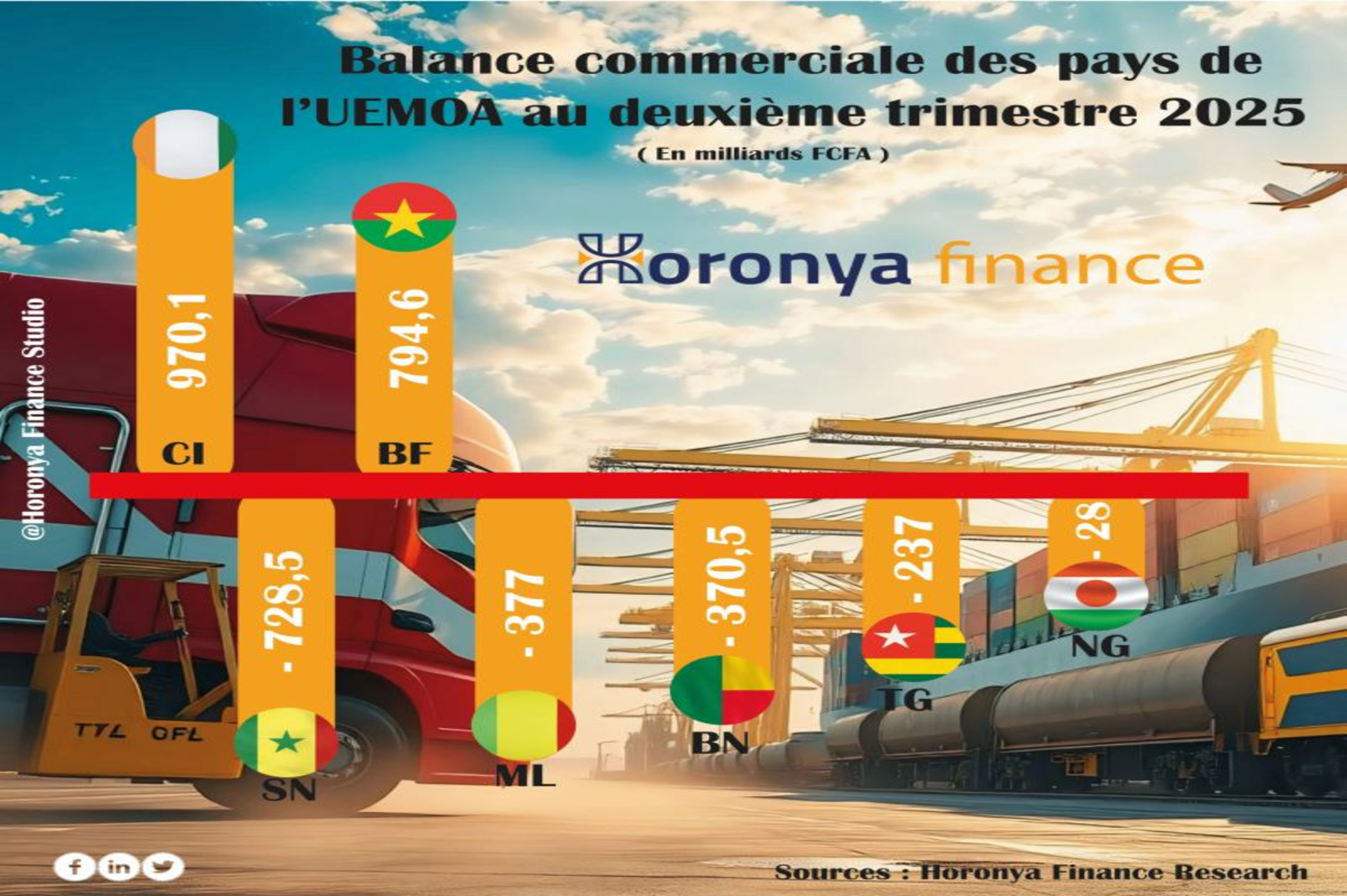

Côte d’Ivoire confirms its status as the commercial engine of the Union. As of June 2025, the country recorded a trade surplus of 970.1 billion CFA francs, a significant increase from the surplus of 397.2 billion recorded one year earlier. This growth is supported by strong export dynamics, which reached nearly 3,900 billion CFA francs, up 34.5%. Gold, cashew nuts, latex, and cocoa beans account for most of this performance, benefiting from both sustained volumes and favorable prices. The import coverage ratio climbed to 133.1%, reflecting an increased capacity to finance foreign purchases. However, this strength remains largely dependent on primary products, while imports, driven by petroleum products, equipment, and vehicles, continue to rise.

Burkina Faso also recorded remarkable performance, with a record trade surplus of 794.6 billion CFA francs as of June 2025. This dramatic improvement is largely attributable to soaring gold exports, whose value increased by more than 100% year-on-year, driven by rising global prices and sustained industrial production. Total exports reached nearly 2,895 billion CFA francs, making the mining sector the near-exclusive pillar of foreign sales, accounting for almost 88% of the total. Meanwhile, imports rose by 15.5%, driven by capital goods, industrial inputs, and food products, illustrating the growing needs of an economy under security constraints but still dependent on external sources.

In contrast, Niger saw its trade balance deteriorate in the second quarter of 2025, returning to a deficit of 28.4 billion CFA francs after a surplus in the previous quarter. The decline in crude oil exports, the country’s main export product, coupled with a sharp increase in petroleum imports, heavily weighed on trade. While mining and agricultural exports show signs of recovery, they remain insufficient to offset the drop in hydrocarbons, revealing the country’s high vulnerability to sectoral shocks.

Togo continues a deficit trajectory, with a negative trade balance of 237.4 billion CFA francs in the second quarter of 2025. Exports, dominated by phosphates, plastic products, and refined palm oil, remain modest compared to imports, which are twice as high in value. Despite some diversification of exported products, the productive base remains narrow and insufficient to rebalance foreign trade.

Benin’s situation is even more pronounced, with exports limited to 118.3 billion CFA francs against nearly 489 billion in imports, resulting in a trade deficit of 370.5 billion CFA francs in the second quarter of 2025. The decline in cotton and oilseed sales weighs heavily on external revenue, while imports, although declining quarter-on-quarter, remain high year-on-year, particularly for food products and fertilizers. This situation underscores the fragility of a model heavily dependent on transit trade and minimally processed agricultural products.

Mali also recorded a significant trade deficit, estimated at 377 billion CFA francs in the second quarter of 2025. Despite export growth, mainly driven by gold and agricultural products, the faster increase in imports, dominated by fuels and equipment, keeps the balance in the red. Once again, the trade structure reflects an economy highly dependent on external inputs.

Senegal stands out as the country with the largest trade deficit in UEMOA during the period. As of June 2025, the trade balance showed a negative 728.5 billion CFA francs. Imports, on the rise, were driven by vehicles, rice, and crude oil, while exports grew strongly thanks to the start of crude oil sales, gold, and petroleum products. Despite this dynamic, the high level of imports continues to widen the deficit, illustrating the limits of the recent improvement in export capacity.

Overall, the first half of 2025 highlights a two-speed UEMOA. On one hand, countries like Côte d’Ivoire and Burkina Faso benefit from the commodity boom to strengthen their trade surpluses. On the other hand, several states remain trapped in structural deficits, fueled by a strong dependence on imports and a narrow export base.